AS SEEN ON

Black Friday - Cyber Monday Sale

Nov 25 - Dec 2

Get Your Financial Picture

In Focus To Make Your

Dream Future Possible.

Get Your Financial Picture In Focus To Make Your Dream Future Possible.

We can hear you laughing…

getting your financial picture in focus is like

putting pantyhose on an Octopus.

We can hear you laughing… getting your financial picture in focus

is like putting pantyhose on an Octopus.

CUE THE STRESS REACTION.

If you’re like the majority, opening your bank app on your

phone makes your heart beat faster… whether there’s money in there or not.

If you’re like the majority, opening your bank app on your phone makes your heart beat faster… whether there’s money in there or not.

Whichever way you slice it… The money convo sucks:

Whichever way you slice it…

The money convo sucks:

•

•

•

•

•

•

•

There’s never enough of it

Investing is confusing + overwhelming

Immediate needs always take precedence over the future

No one wants to put off living today for the sake of a tomorrow that might never come

Most households just spend money with literally no idea where it’s going because of the shame attached to spending

There’s a million different people giving advice, showcasing too-good-to-be-true investments that leave you feeling fomo

Most of us are in debt (hello 28 trillion dollar deficit)

There's never enough of it

Investing is confusing + overwhelming

Immediate needs always take precedence over the future

No one wants to put off living today for the sake of a tomorrow that might never come

Most households just spend money with literally no idea where it’s going because of the shame attached to spending

There’s a million different people giving advice, showcasing too-good-to-be-true investments that leave you feeling fomo

Most of us are in debt (hello 28 trillion dollar deficit)

The worst part is these aren’t even myths...

It’s all true and normal, but don’t leave...

...Because this just might be the conversation that changes everything.

Let’s try a quick exercise together.

Put your preconceived ideas of budgeting, financial discipline, debt reduction, and the dreaded envelope system down for a minute.

More importantly, put down any shame & guilt you have around money.

Phew… feeling better already? Good… Because here comes some good news…

Changing your future is not complicated.

It requires you to do four things (they are simple to do, but not easy… but nothing worthwhile ever is).

Here’s The Solution To Money + Investing Confusion

01.

MIND THE GAP

In order to change your future, you have to first understand where you are (guilt free), and the gap that lies between today and tomorrow.

Most people don’t do this because of shame around money + budgets. Instead, We need to throw the budget out for good, and really get a good grasp of how your lifestyle shakes out in terms of dollars and cents.

02.

Build the Bridge

Next, you’ll need a plan to bridge that gap. A plan that you can actually use, in real life, when unpredictable things happen.

Inevitably there’s a gap, and that’s okay. That’s normal! Instead of spinning out with excessive restrictions or binges, let’s build a plan we’re in charge of. One that feels good and works with a life that is anything but static.

The spreadsheet doesn’t tell us what to do. We tell the spreadsheet what we do. The shift is subtle, but massive.

03.

dig for the gold

Once you have those two things, it’s time to dive into the weeds and harvest some investable cash, even if you think you have none right now (or are drowning in debt).

This is a combination of strategy, tactic, and mindset. Most people here push off their dream of tomorrow further and further away, while they attend to immediate financial crunches like debt and emergency funds.

There’s a new way to look at investing, backed by psychology and money principles.

04.

pick your ponies

Lastly, you need a framework for picking solid investments that match your personality, lifestyle, interests, and money on hand.

All those great money books do no good if the information stays in your head. It’s hard to shift through someone else’s opinion and money story to make sure it’s the right fit for you.

So it’s time to create a framework around your current cash situation, your personality, your interest level, and your desired risk threshold.

Some of you might be saying yes I want this!

You avoidant types are slowly moving to click the X on this page.

Don’t.

Yes. This will take some courage.

“Plan for what it is difficult while it is easy, do what is great while it is small.”

― Sun Tzu, The Art of War

But we promise, it’s worth it.

(Especially because we are going to toss the restrictive bossy

pants family budget into the trash for good.)

FF includes:

It doesn’t matter if you have $10,000,000 or $10...

Future Fund uses time tested real life strategy to help you…

•

•

•

•

Small business owners

Freelancers

Scaling entrepreneurs

Employees with an active side-hustle

Small business owners

Freelancers

Scaling entrepreneurs

Employees with an active side-hustle

It doesn’t matter if you have

$10,000,000 or $10...

Future Fund uses time tested real

life strategy to help you…

1. Identify your 4 core numbers that drive your current and future financial decisions

2. Understand the core 7 types of investments

3. Harvest the first amount of investable cash

4. Build a framework for solid investment decisions

5. Get back in the driver's seat, make the investment, and change your story

With Future Fund, here are some of the things you can look forward to…

With Future Fund,

here are some of the things

you can look forward to…

Know exactly how much money you need to fund the lifestyle you want….even after you stop working

Gain confidence in your investment decisions without worrying that you’re listening to a financial planner who’s trying to sell you something not in your best interest

Never get scammed into a risky investment again

Pick investment types that don’t tie up your money forever (cough cough, 401ks)

Anticipate your future expenses and lifestyle so you don’t get caught in an investment that’s too expensive

Manage your lifestyle and investments without needing a restrictive budget

Get your spendy spouse on board, without having to police their spending habits

Understand the rate of return, tax implications, risk/benefit analysis of each of the big 7 types of investments

Speak confidently about investing, without worrying that you’re saying something off the wall

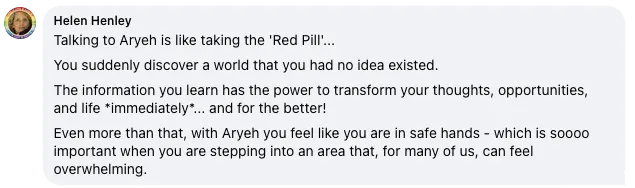

Transform your mindset around money and investing so you feel in charge of your finances

Build a financial map that you can come back to again and again...one that’s flexible enough to endure changes

Most importantly, with Future Fund, you can CHANGE your money story. How you use it, spend it, invest in it, and live with it. With a combination of education, strategy, and mindset work, you’ll be back in the driver’s seat with your finances, even if they feel like a hot mess right now.

What You’ll Master In Future Fund

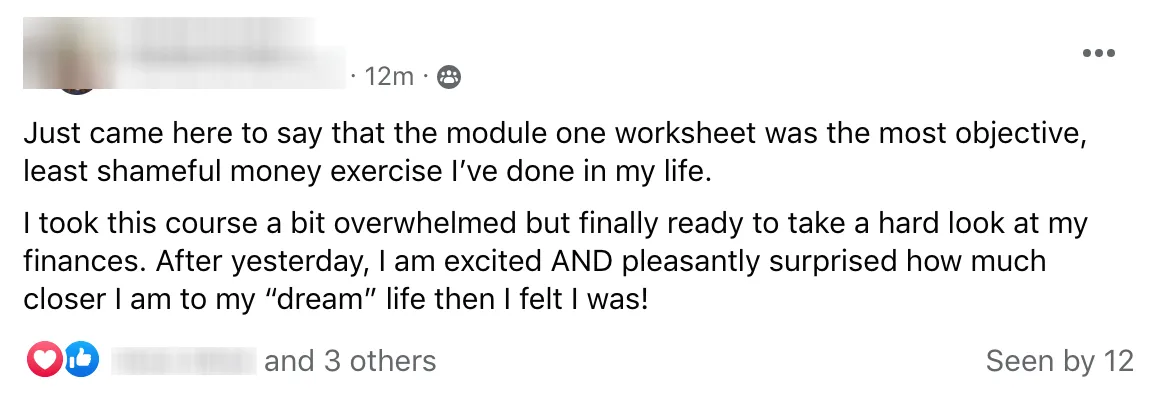

Module 1 Your Financial Map

Build an accurate snapshot of the cost of your current lifestyle.

Discover how you live and how that impacts your finances. Throw away all guilt and shame, and explore what you want and what it costs to fulfill those desires. Plus, we’ll put to death the traditional family budget for good.

Stop living by a restrictive budget

Build a true picture of the lifestyle you want to live

Know Your Core Number #1

BONUS TOOL: Lifestyle Spend Spreadsheet (Value $49)

Module 2 The Pot Of Gold

Know exactly what you need to invest to live the life you want, without working til the day you die.

99% of people have no idea how to fund their lifestyle to the end. In Module 2, you will quickly be able to figure this out, and learn how to structure your business finances to maximize what you can invest into your future.

Know Your Core Numbers #2 + #3

A clear roadmap for how to structure your business finances to maximize investable cash

Leverage Parkinson’s Law to enact change even if you don’t earn another cent

BONUS TOOL: Divide Up Your Business Profits Worksheet (Value $49)

Module 3 Consumption To Production

Put your money to work for you!

Create an investing plan around your core number #4, plus build a clear to do list of how to adjust your numbers if your current situation isn’t ideal.

Know Your Core Number #4

Create a game plan for generating the rate of return you need on your money

Shed the consumerism story we’re all told, and become a producer

BONUS TOOL: Aryeh Will Calculate Your ROR For You (Value $1000)

Module 4 The Big 7

Finally understand the 7 most popular types of investments, and the benefits and downsides to each.

Take a deep dive into stocks, fixed income investments, cash value life insurance, real estate investing, cryptocurrency, investable businesses, and collectibles & NFTs.

Learn the benefits & downsides to each

Discover the multitude of options inside each one of The Big 7

Real life examples to see how it could work in your financial plan

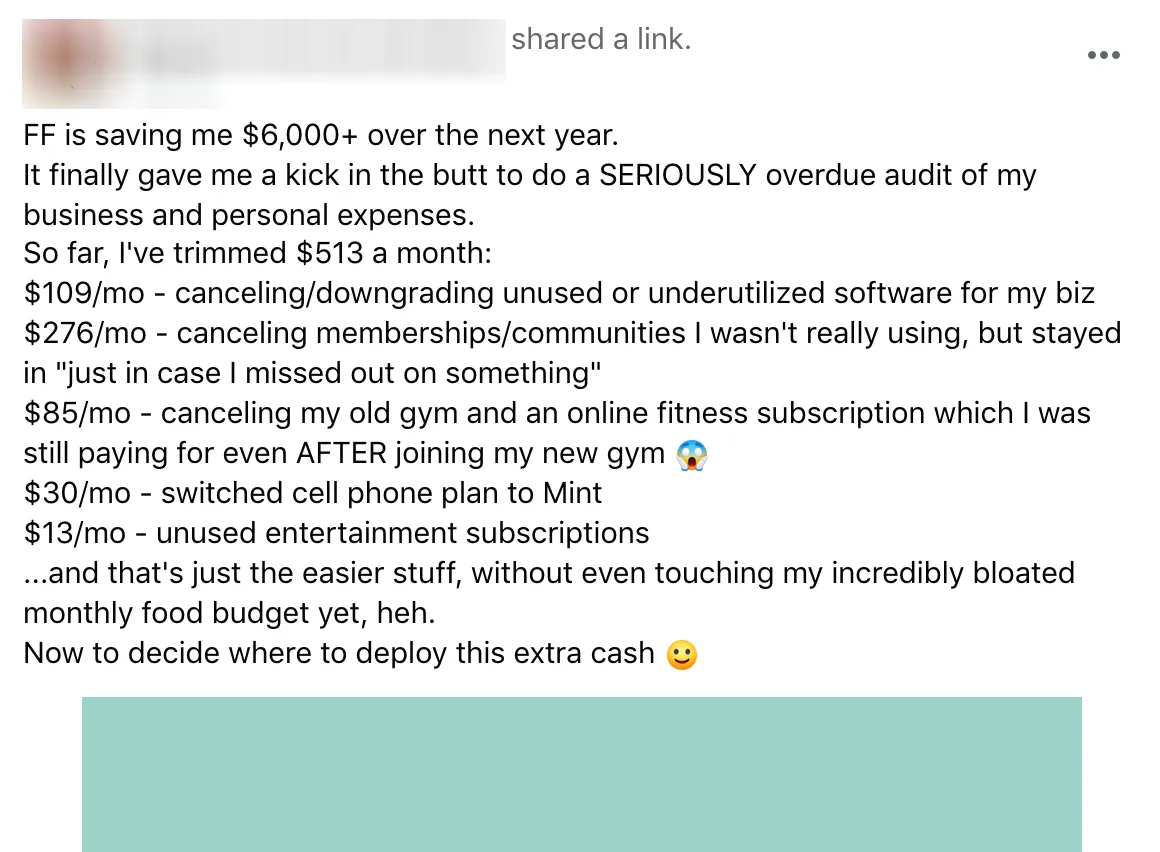

Module 5 Unearthing Your Investable Cash

Using the rule of 72 and our best cash hacks, we’ll help you find your first investable money.

Once you’ve got a good vision for where you are (and where you want to be), Module 5 will help you find money you didn’t know you had to make your first investment. This is a combination of financial gymnastics and mindset work.

Learn the rule of 72 and use it to make investing seem doable

Deploy our cash finding strategies to get your first amount ready to go

Transform your thinking around investing permanently - from overwhelm to fun

Module 6 The Investment Filter

Use our framework to pick the right investment container for your investable cash.

Avoid that feeling of missing out or shiny object syndrome when you see someone talking about their “big ROR” on an investment. Know what you want, and why you want it, and pick the right vehicles to optimize your rate of return that also aligns with your personality and lifestyle.

Use our investment filter to avoid bad investments for you

Know the rate of return you need

Get resources for where to start with each of the big 7 types of investing

BONUS: Re-Tracing My Steps - How I Got Here (Value $1000)

Inside each module you’ll get the training, expert advice, and

the worksheets + examples to take action on your own finances!

Inside each module you’ll get live training, expert advice, and the worksheets + examples to take action on your own finances!

Plus, included with Future Fund are some pretty epic extras!

Plus, included with Future Fund

are some pretty epic extras!

BONUS#1 Re-Tracing My Steps (How I Got Here)

Julie's presentation chronicles her remarkable 10-year journey from having $0 to amassing a net worth of millions. In this step-by-step account, Julie shares the key decisions, strategies, and mindset shifts that propelled her success. From her humble beginnings to her first $1000 in savings, Julie offers valuable insights into how she navigated challenges and capitalized on opportunities.

BONUS#2 Your Personality + Money

Guest training with Nicole McDonough on what common strengths (and areas of focus) there are for each of the 9 personality types when it comes to your views and relationship with money.

BONUS#3 Debt Reduction Strategy With Aryeh

For those of you who are in debt and need creative ways to get out, Aryeh presents a comprehensive Debt Reduction Plan. This invaluable resource offers practical strategies and innovative approaches to help you break free from the burden of debt, providing step-by-step guidance on managing your finances and implementing effective techniques to accelerate your journey to becoming debt-free.

BONUS#4 Six Weeks Months Pop Up FB Group

As an exclusive bonus for Research Round Future Fund students, we're offering a six-month Pop Up Facebook Group. This community provides a supportive space where you can ask questions, seek guidance, and connect with like-minded individuals who are also on the path to financial success.

BONUS#4 Fifty Cent Method + 30 Days Ticker Service

For those of you who are ready to invest just $5.00 and grow it to $1000 or more in just SECONDS a day! This comprehensive step-by-step guide, along with 30 Day free trial of the Ticker Service, empowers you to harness investing momentum even as a beginner. The beauty of this offer is that your 30-day trial starts whenever YOU are ready, giving you the flexibility to embark on your investment journey at your own pace.

BONUS#5 Fifty Cent Method + 30 Days Ticker Service

For those of you who are ready to invest just $5.00 and grow it to $1000 or more in just SECONDS a day! This comprehensive step-by-step guide, along with 30 Day free trial of the Ticker Service, empowers you to harness investing momentum even as a beginner. The beauty of this offer is that your 30-day trial starts whenever YOU are ready, giving you the flexibility to embark on your investment journey at your own pace.

BONUS#5 Popup Community on Facebook (until October 31st)

Join your fellow Future Funders in a private pop up Facebook to talk money, savings, investments. Ask questions in a safe and supportive environment where bad advice is banned.

The Future Fund Promise

Join Future Fund, explore the materials, and watch the trainings. If after 14 days, you feel that this course is not going to help you discover your four core numbers, help you find investable cash, reframe the way you see how your business + personal finances work, and give you the best advice on investing, feel free to email us at [email protected] for a full refund.

“Someone's sitting in the shade today because someone planted a tree a long time ago.”

― Warren Buffett

FF includes:

And these bonuses:

•

•

•

•

•

•

Module 1: Your Financial Map

Value $197

Module 2: The Pot Of Gold

Value $197

Module 3: Consumption To Production

Value $197

Module 4: The Big 7

Value $197

Module 5: Unearthing Your Investable Cash

Value $197

Module 6: The Investment Filter

Value $197

• Module 1: Your Financial Map

Value $197

• Module 2: The Pot Of Gold

Value $197

• Module 3: Consumption To Production

Value $197

• Module 4: The Big 7

Value $197

• Module 5: Unearthing Your Investable Cash

Value $197

• Module 6: The Investment Filter

Value $197

And these bonuses:

BONUS #1: Re-Tracing My Steps (How I Got Here) with Julie

Value $1000

BONUS #2: Your Personality + Money

Value $500

BONUS #3: Debt Reduction Strategy With Aryeh

Value $1000

BONUS #4: Fifty Cent Method + 30 Days Ticker Service

Value $1000

Total Value = $5,780

Regular Price = $1397

Research Round Price = Only $698.50

OR 3 payments of $249/month

OR

You Asked, we answered

Will this course work for me if I’m not in the United States?

Yes absolutely! We’re giving you time tested money principles that you can use regardless of where you live, and when we get to the investment piece, you will be able to leverage the same strategies with whatever options you have available in your country.

I am in debt and don’t have money to invest!

Don’t worry. Most people are in your situation. And in fact, it’s one of the big lies that keep people stuck. They never get to “wealth” building mode because they think they don’t qualify until they’re out of debt. Not realizing that getting out of debt is partially about building wealth! This course is especially for you.

I’m already working with a financial advisor.

Awesome! This course actually will help you in your financial conversations tremendously. Since it’s a strategic course, rather than some 1-size-fits-all tactic, it should work quite nicely with your financial advisor’s plan, and may give you some new ideas!

I’m just starting a business and don’t have a lot of money flowing yet.

No worries. This course is fully usable even if you’re working with a paycheck. You’ll just use your salary as the starting point. And when your business starts cookin’, you’ll have the materials to look back on.

Will this teach me about cryptocurrency?

Yes we will cover cryptocurrency as one of the big 7 types of investments.

Will you give me advice on what stocks to choose?

Aryeh probably won’t whip out his Magic 8 Ball of stocks for this course (kidding), but he will be there to answer your questions and provide best practices on choosing stock options.

I’m terrible with money and budgets. Will this force me to live by one?

There’s a difference between being a slave to a budget, vs. having a way to document what you’re doing. That’s the simple difference. The spreadsheet isn’t telling you what you can and can’t do with your money. It’s showing you what you did so you can have the information handy to help you make informed choices.

What time are the calls and what if I’m not in the right timezone?

Everything is recorded and available to you, and all the bonuses are pre-recorded.

How much time will this course take?

One hour a week for six weeks.

FF includes:

And these bonuses:

•

•

•

•

•

•

Module 1: Your Financial Map

Value $197

Module 2: The Pot Of Gold

Value $197

Module 3: Consumption To Production

Value $197

Module 4: The Big 7

Value $197

Module 5: Unearthing Your Investable Cash

Value $197

Module 6: The Investment Filter

Value $197

• Module 1: Your Financial Map

Value $197

• Module 2: The Pot Of Gold

Value $197

• Module 3: Consumption To Production

Value $197

• Module 4: The Big 7

Value $197

• Module 5: Unearthing Your Investable Cash

Value $197

• Module 6: The Investment Filter

Value $197

And these bonuses:

BONUS #1: Re-Tracing My Steps (How I Got Here) with Julie

Value $1000

BONUS #2: Your Personality + Money

Value $500

BONUS #3: Debt Reduction Strategy With Aryeh

Value $1000

BONUS #4: Fifty Cent Method + 30 Days Ticker Service

Value $1000

Total Value = $5,780

Regular Price = $1397

Research Round Price = Only $698.50

OR 3 payments of $249/month

OR

Ready for a big A-ha? Here it goes.

One of the most important pieces of advice about money and wealth building, we’re going to give you right now (no need to buy the course to learn it).

It doesn't matter how little you have,

the best day to start thinking differently about wealth...is today.

It doesn't matter how little you have, the best day to start thinking differently about wealth...is today.

Most people will read that and have one of two reactions:

1.

Heard that before (yawn)

2.

*inserts fingers in ears* I can’t hear what you’re saying because the guilt and shame and fear is too loud and I would rather ostrich.

The third option is quieter than those two.

It says, “Okay, maybe it’s time I take a closer look. Without judgment or fear or shame.”

It says, “Okay, maybe it’s time I

take a closer look. Without

judgment or fear or shame.”

And we’d gather that this is the first time you will be having the money

discussion with a combination of…

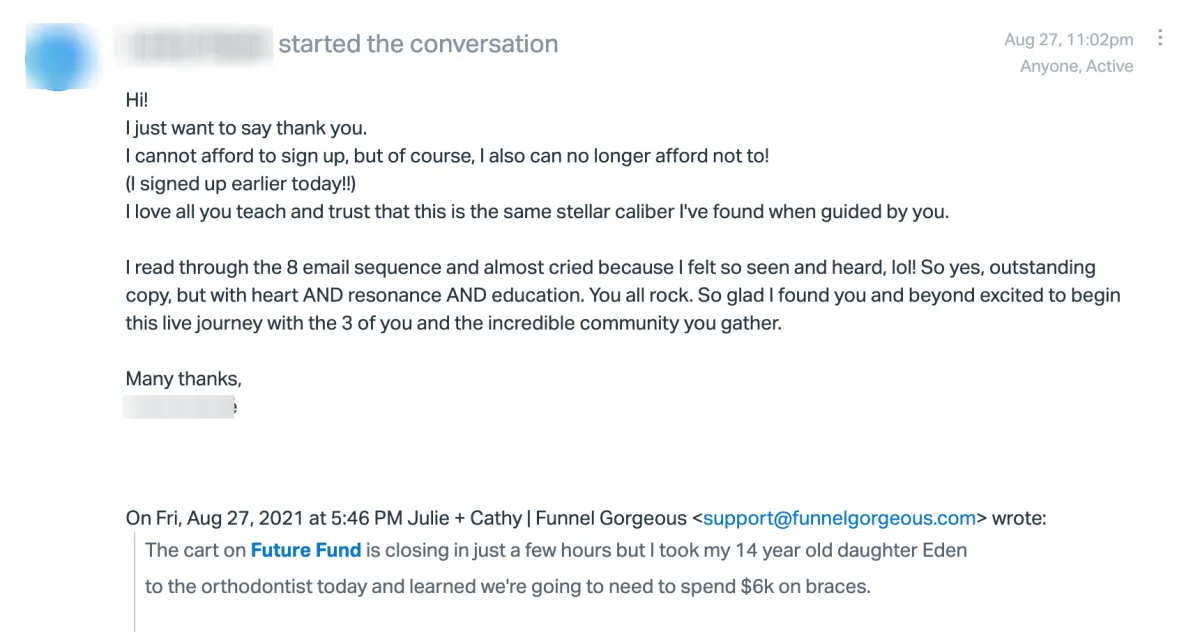

Teaching expertise (Julie’s world-renowned teaching style)

Money expertise (Aryeh’s Wall Street money brain)

Personal experience expertise (Julie’s personal experience going from very little to a lot)

Brand expertise (the Funnel Gorgeous vibe - Ethical, fun, and supportive)

OR

Your opportunity to join the first (and most likely only) live round of Future Fund ends in…

Xx Julie, Cathy, Aryeh

© Copyright 2021-2025 Funnel Gorgeous LLC.

FOR SUPPORT ISSUES OR QUESTIONS, PLEASE EMAIL US AT [email protected]